Machine Learning for Trading (with Python)¶

The Rise Of The Machines In Search For Alpha¶

© Ran Aroussi

@aroussi | aroussi.com | github.com/ranaroussi

September, 2018

Agenda¶

- Machine Learning Overview

- The Machine Learning Workflow

- Common Machine Learning Algorithms

- ML Algorithms for Trading

- Example of a Trading Strategy that uses ML

- Further Reading

Machine Learning Overview¶

Machine Learning

What is Machine Learning?¶

Machine learning is the science of getting computers to act without being explicitly programmed. It uses statistical techniques to give computers the ability to "learn" from data.

* Note that ML research is a close neighbour of data mining, and hence overfitting is something you should pay very close attention to.

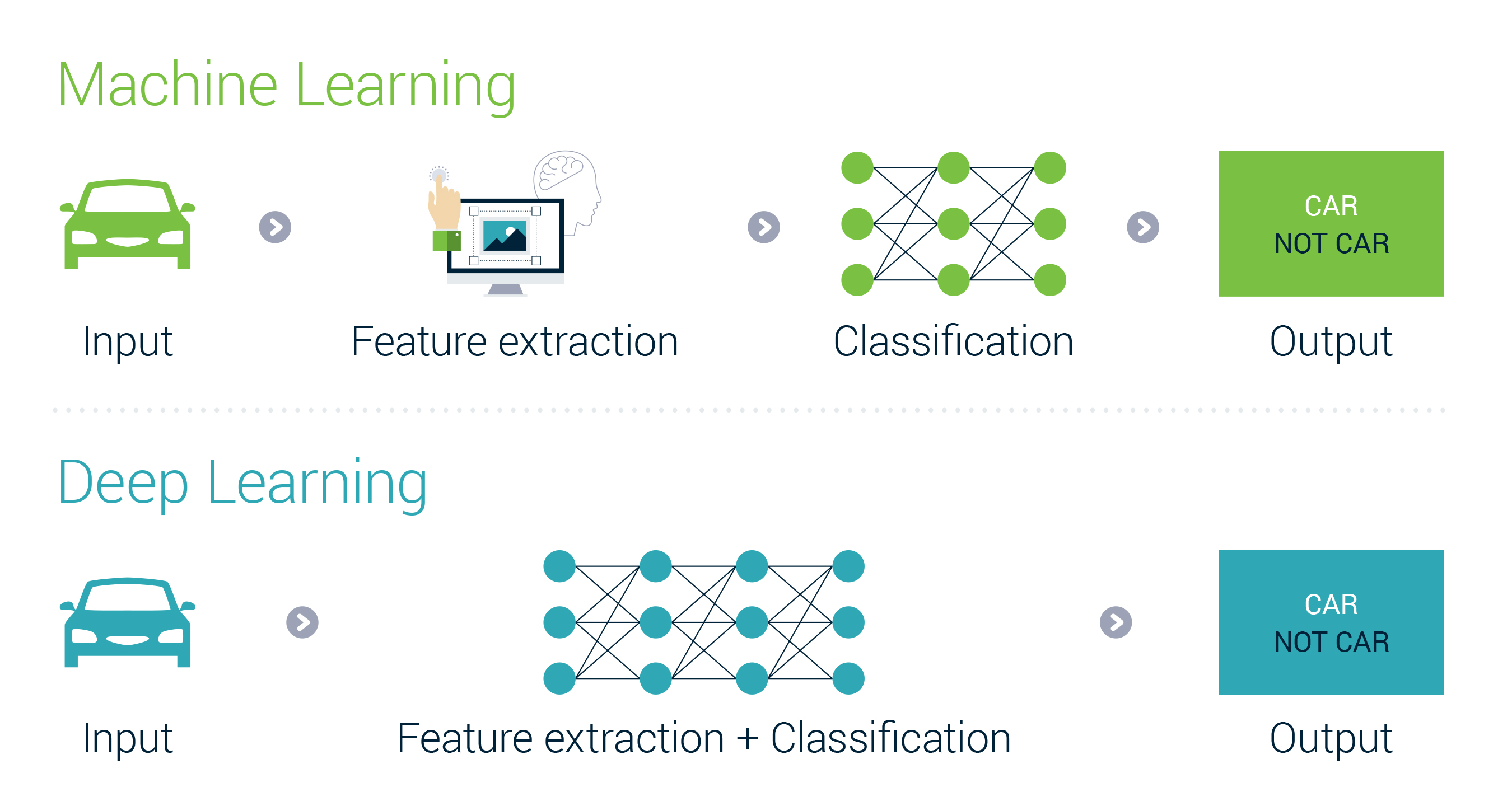

Maching Learning vs. Deep Learning

- Machine learning uses algorithms to parse data, learn from that data, and make informed decisions based on what it has learned.

- Deep learning structures algorithms in layers to create an “artificial neural network” that can learn and make intelligent decisions on its own.

Deep learning is a subfield of machine learning. While both fall under the broad category of artificial intelligence, deep learning is what powers the most human-like artificial intelligence.

Machine Learning Algorithms¶

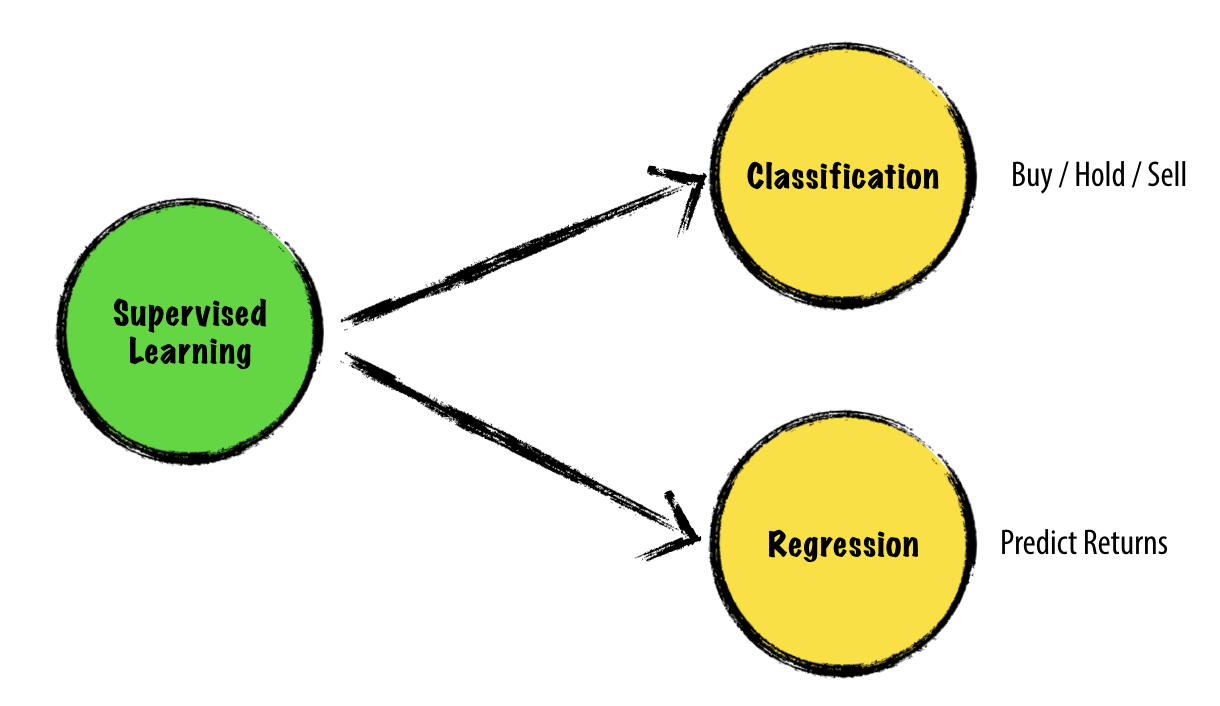

Machine Learning Algorithms¶

- Unupervised Learning: based on input

- Supervised Learning: based on input + output

- Reinforced Learning: based on feedback

- Deep Learning: based on nothing :)

The Machine Learning Workflow¶

The Machine Learning Workflow¶

- Data Gathering + Cleaning

- Feature Engineering + Normalization

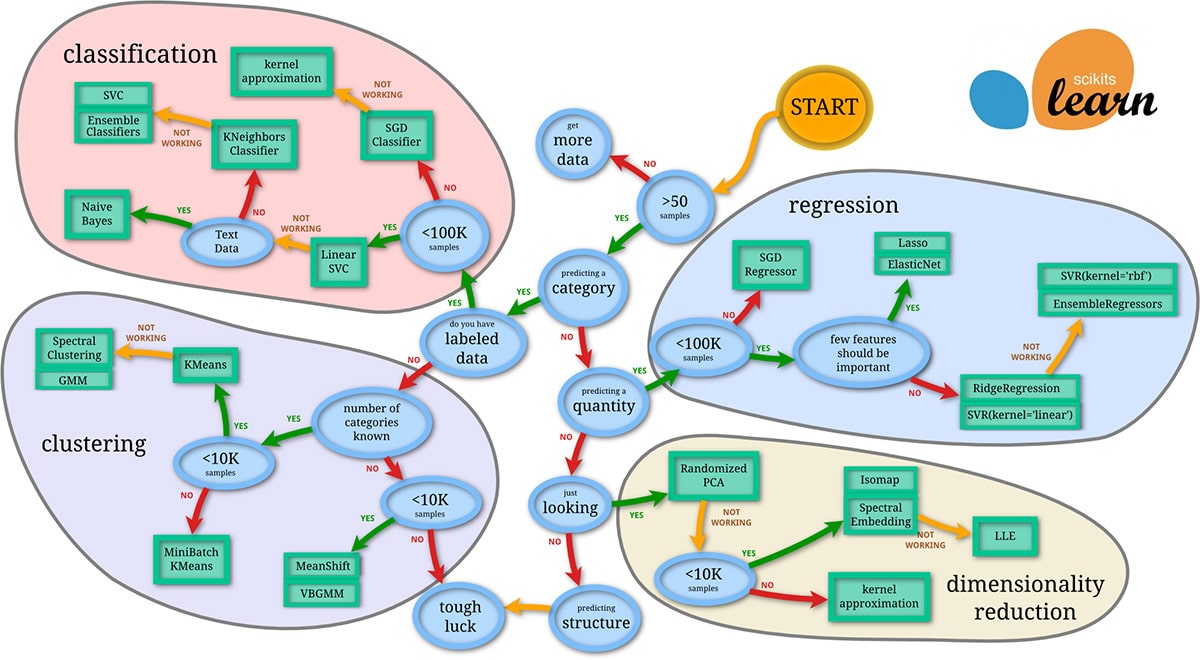

- Model Selection

- Split Data

- Train Data

- Test Data

Feature Engineering ≈ Alpha Factors¶

Features are attributes that holds some predictive power over the end result

Examples:

- Previous N days returns

- Inter-market relationships

- Technical indicators

Machine Learning for Trading¶

Machine Learning for Trading¶

ML Algorithms for "Beginners"¶

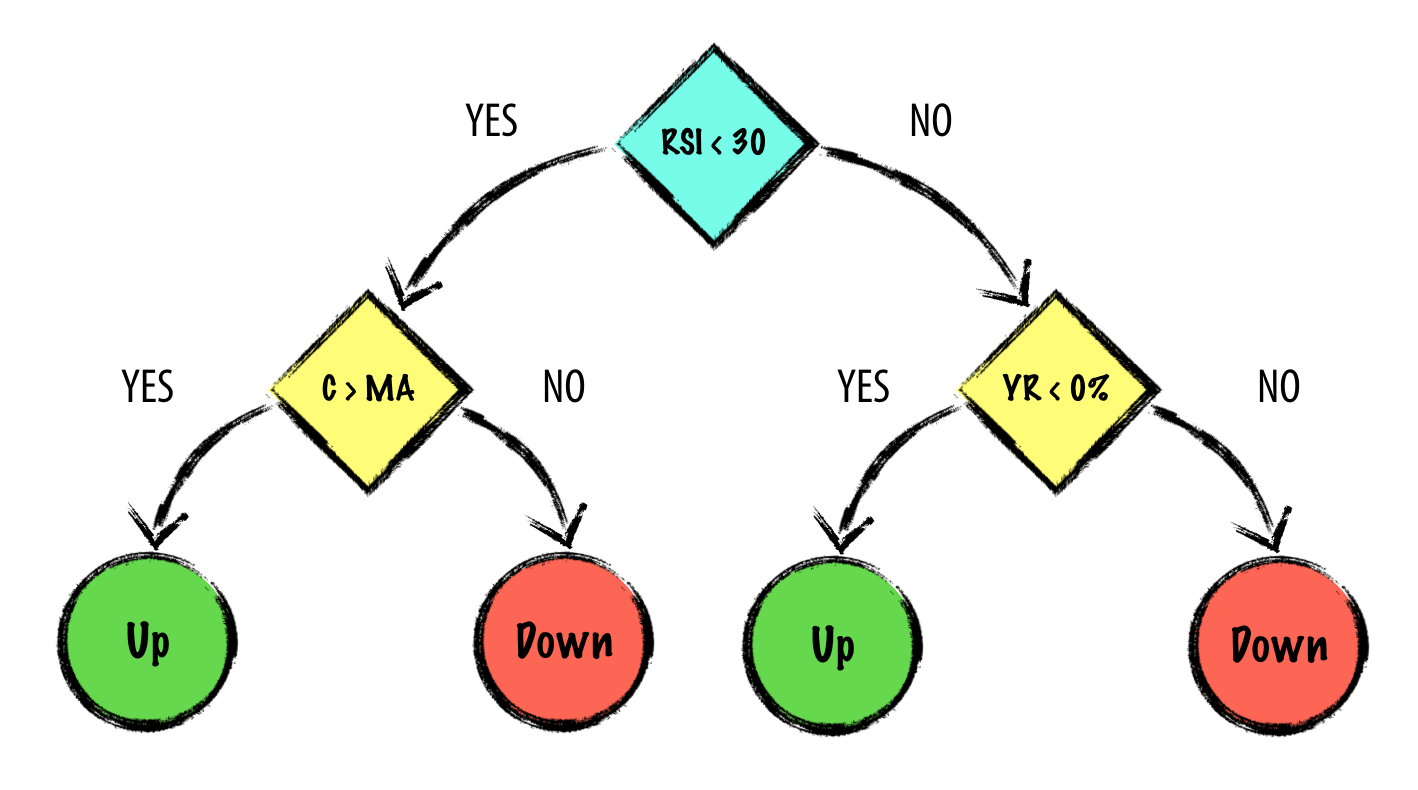

The two ML algorithems that are easiest to get started with are Decision Trees and K Nearest-Neighbours. They are both easy to comprehend and works for either Regression or Classification.

KNN (K Nearest-Neighbours)¶

- Training is fast

- Query is slow

- Requires data normalization

- Needs features

Decision Trees¶

- Training is slow

- Query is fast

- No need for data normalization

- Auto-discover features

Example: Predicting Tomorrow's Direction using a Decision Tree Algorithm¶

In [3]:

from sklearn.tree import DecisionTreeClassifier

from sklearn import preprocessing

from sklearn.model_selection import cross_val_score

from sklearn.metrics import accuracy_score

Get Data¶

In [4]:

symbols = ["^GSPC", "^VIX", "^VXV"]

raw = pd.read_pickle('ml-raw-data.pkl')

df = pd.DataFrame()

for symbol in symbols:

new_symbol = symbol.replace("^", "").replace("GSPC", "SPX")

df[new_symbol] = raw[symbol]['Close']

df.tail()

Out[4]:

| SPX | VIX | VXV | |

|---|---|---|---|

| Date | |||

| 2018-09-14 | 2904.979980 | 12.07 | 14.37 |

| 2018-09-17 | 2888.800049 | 13.68 | 15.28 |

| 2018-09-18 | 2904.310059 | 12.79 | 15.04 |

| 2018-09-19 | 2907.949951 | 11.75 | 14.65 |

| 2018-09-20 | 2932.149902 | 11.52 | NaN |

Prepare Features (input)¶

In [5]:

df['SPXVOL'] = raw['^GSPC']['Volume'].pct_change() * 100

df['SPX1D'] = raw['^GSPC']['Close'].pct_change() * 100

df['VIX1D'] = raw['^VIX']['Close'].pct_change() * 100

df['VXV1D'] = raw['^VXV']['Close'].pct_change() * 100

df['SPXHL'] = raw['^GSPC']['Open'] - raw['^GSPC']['Low']

df['SPXOC'] = raw['^GSPC']['Open'] - raw['^GSPC']['Close']

df['SPXO2C'] = ((raw['^GSPC']['Close'] / raw['^GSPC']['Open']) - 1) * 100

df.dropna(inplace=True)

df.tail()

Out[5]:

| SPX | VIX | VXV | SPXVOL | SPX1D | VIX1D | VXV1D | SPXHL | SPXOC | SPXO2C | |

|---|---|---|---|---|---|---|---|---|---|---|

| Date | ||||||||||

| 2018-09-13 | 2904.179932 | 12.37 | 14.77 | -0.306285 | 0.528225 | -5.859970 | -3.590078 | 0.460205 | -7.329834 | 0.253028 |

| 2018-09-14 | 2904.979980 | 12.07 | 14.37 | -3.229870 | 0.027548 | -2.425222 | -2.708192 | 10.609863 | 1.399903 | -0.048167 |

| 2018-09-17 | 2888.800049 | 13.68 | 15.28 | -6.414376 | -0.556972 | 13.338857 | 6.332637 | 17.670166 | 15.030029 | -0.517593 |

| 2018-09-18 | 2904.310059 | 12.79 | 15.04 | 4.303268 | 0.536901 | -6.505848 | -1.570681 | 0.310058 | -13.570069 | 0.469432 |

| 2018-09-19 | 2907.949951 | 11.75 | 14.65 | 6.680847 | 0.125327 | -8.131353 | -2.593085 | 2.780030 | -1.349853 | 0.046441 |

Prepare target (output)¶

In [6]:

df['target'] = np.where(df["SPXO2C"] >= 0, 1, np.where(df["SPXO2C"] < 0, -1, 0))

df['target'] = df['target'].shift(-1) # next day

df.dropna(inplace=True)

df.tail(10)

Out[6]:

| SPX | VIX | VXV | SPXVOL | SPX1D | VIX1D | VXV1D | SPXHL | SPXOC | SPXO2C | target | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | |||||||||||

| 2018-09-05 | 2888.600098 | 13.91 | 15.92 | 5.335938 | -0.280313 | 5.699088 | 3.042071 | 14.670166 | 2.989990 | -0.103403 | -1.0 |

| 2018-09-06 | 2878.050049 | 14.65 | 16.34 | -3.136444 | -0.365231 | 5.319914 | 2.638191 | 21.349854 | 10.589844 | -0.366603 | 1.0 |

| 2018-09-07 | 2871.679932 | 14.88 | 16.59 | -6.157492 | -0.221334 | 1.569966 | 1.529988 | 4.139893 | -3.419922 | 0.119233 | -1.0 |

| 2018-09-10 | 2877.129883 | 14.16 | 16.17 | -7.292950 | 0.189783 | -4.838710 | -2.531646 | 5.449952 | 4.260010 | -0.147846 | 1.0 |

| 2018-09-11 | 2887.889893 | 13.22 | 15.54 | 6.160211 | 0.373984 | -6.638418 | -3.896104 | 4.790039 | -16.319825 | 0.568324 | 1.0 |

| 2018-09-12 | 2888.919922 | 13.14 | 15.32 | 12.596994 | 0.035667 | -0.605144 | -1.415701 | 9.090088 | -0.629883 | 0.021808 | 1.0 |

| 2018-09-13 | 2904.179932 | 12.37 | 14.77 | -0.306285 | 0.528225 | -5.859970 | -3.590078 | 0.460205 | -7.329834 | 0.253028 | -1.0 |

| 2018-09-14 | 2904.979980 | 12.07 | 14.37 | -3.229870 | 0.027548 | -2.425222 | -2.708192 | 10.609863 | 1.399903 | -0.048167 | -1.0 |

| 2018-09-17 | 2888.800049 | 13.68 | 15.28 | -6.414376 | -0.556972 | 13.338857 | 6.332637 | 17.670166 | 15.030029 | -0.517593 | 1.0 |

| 2018-09-18 | 2904.310059 | 12.79 | 15.04 | 4.303268 | 0.536901 | -6.505848 | -1.570681 | 0.310058 | -13.570069 | 0.469432 | 1.0 |

Split Data into training and testing¶

In [7]:

feature_cols = [col for col in df.columns if col not in ['target']]

features = df[feature_cols].values

labels = df['target'].values.flatten()

# split df

train_test_split = .9

sample = int( len(df.index) * train_test_split )

train_features = features[:-sample]

train_labels = labels[:-sample]

test_features = features[-sample:]

test_labels = labels[-sample:]

Normalize data¶

In [8]:

# normalize

normalizer = preprocessing.Normalizer()

train_features = normalizer.fit(train_features).transform(train_features)

Do ML Stuff¶

In [9]:

# init classifier

clf = DecisionTreeClassifier()

# fit

clf.fit(train_features, train_labels)

Out[9]:

DecisionTreeClassifier(class_weight=None, criterion='gini', max_depth=None,

max_features=None, max_leaf_nodes=None,

min_impurity_decrease=0.0, min_impurity_split=None,

min_samples_leaf=1, min_samples_split=2,

min_weight_fraction_leaf=0.0, presort=False, random_state=None,

splitter='best')

In [10]:

# predict

prediction = clf.predict(test_features)

# score

accuracy_score(test_labels, prediction)

Out[10]:

0.5395213923132705

In [11]:

scores = cross_val_score(clf, features, labels, cv=10)

print("Mean %.2f%%, Std: %.2f" % (scores.mean()*100, scores.std()*100) )

Mean 51.38%, Std: 2.72

Test Strategy¶

In [12]:

testdf = df[-sample:].copy()

testdf['predicted'] = prediction

testdf.tail()

Out[12]:

| SPX | VIX | VXV | SPXVOL | SPX1D | VIX1D | VXV1D | SPXHL | SPXOC | SPXO2C | target | predicted | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | ||||||||||||

| 2018-09-12 | 2888.919922 | 13.14 | 15.32 | 12.596994 | 0.035667 | -0.605144 | -1.415701 | 9.090088 | -0.629883 | 0.021808 | 1.0 | 1.0 |

| 2018-09-13 | 2904.179932 | 12.37 | 14.77 | -0.306285 | 0.528225 | -5.859970 | -3.590078 | 0.460205 | -7.329834 | 0.253028 | -1.0 | 1.0 |

| 2018-09-14 | 2904.979980 | 12.07 | 14.37 | -3.229870 | 0.027548 | -2.425222 | -2.708192 | 10.609863 | 1.399903 | -0.048167 | -1.0 | -1.0 |

| 2018-09-17 | 2888.800049 | 13.68 | 15.28 | -6.414376 | -0.556972 | 13.338857 | 6.332637 | 17.670166 | 15.030029 | -0.517593 | 1.0 | 1.0 |

| 2018-09-18 | 2904.310059 | 12.79 | 15.04 | 4.303268 | 0.536901 | -6.505848 | -1.570681 | 0.310058 | -13.570069 | 0.469432 | 1.0 | 1.0 |

In [13]:

testdf['strategy'] = testdf['predicted'].shift(1) * testdf['SPXO2C']

testdf[['SPX1D', 'strategy']].cumsum().plot()

Out[13]:

<matplotlib.axes._subplots.AxesSubplot at 0x1a1c9abb00>

and... We're Done :)¶

This was the part 4 out of the 4-part webinar series

Prototyping Trading StrategiesBacktesting & OptimizationLive TradingUsing Machine Learning in Trading

Webinars available @ aroussi.com/webinars

Further Reading¶

Machine Learning for Trading (with Python)¶

Thank you for attending!¶

© Ran Aroussi

@aroussi | aroussi.com | github.com/ranaroussi

September, 2018